US Delays Tariff Hikes for 90 Days, Increases Pressure on China

A Strategic Shift in U.S. Trade Policy

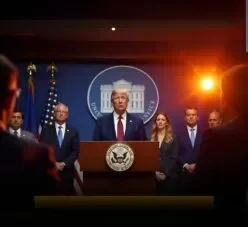

President Donald Trump unveiled a critical adjustment to U.S. trade policy, suspending tariff hikes on most nations for 90 days while imposing a steep 125% tariff on Chinese imports. Announced via a Truth Social post, this decision reflects a deliberate shift in the intensifying U.S.-China trade conflict. It seeks to mitigate domestic economic strain while applying unrelenting pressure on Beijing to address trade disparities, reinforcing America’s stance on fair competition.

Details of the Tariff Delay and Escalation

The 90-day suspension reduces tariffs to a uniform 10% for dozens of countries, effective immediately, reversing a week of market turmoil sparked by earlier tariff threats. In stark contrast, China’s tariff rate jumped from 104% to 125%, a response to Beijing’s retaliatory 84% duties on U.S. exports. The White House underscored this dual strategy—offering temporary global relief while targeting China with heightened measures—as a calculated step toward rebalancing trade dynamics and fostering negotiations rooted in mutual accountability.

Implications for U.S.-China Relations

This policy amplifies tensions between the globe’s economic titans. China’s Foreign Ministry, through spokesperson Lin Jian, denounced the 125% tariff as a “blunt instrument of coercion,” pledging steadfast resistance to U.S. pressure tactics. Trump defended the escalation, arguing that China’s disregard for equitable market practices necessitated a firm response. This stance has polarized opinions, with some praising it as a bold defense of U.S. interests, while others caution it risks fracturing diplomatic ties further.

Global Economic Reactions

Markets reacted swiftly, with the S&P 500 surging 9.5% on April 9—its largest single-day gain since 2008—as investors welcomed the broader tariff reprieve. However, by April 10, Wall Street faltered, reflecting unease over U.S.-China friction. Goldman Sachs analysts slashed China’s 2025 GDP growth projection to 4.0%, attributing the downgrade to the tariff’s projected impact on exports. Meanwhile, the European Union deferred its retaliatory measures, aligning its timeline with the U.S. to monitor unfolding developments.

Looking Ahead: Trade Talks and Stability

The next 90 days will determine whether this delay catalyzes productive dialogue or entrenches uncertainty. Experts from JP Morgan estimate the 125% tariff could slash China’s U.S. exports by half, endangering millions of jobs and driving U.S. consumer costs up by $860 billion annually. Manufacturers reliant on Chinese components, such as electronics and automotive sectors, face looming price hikes, potentially fueling inflation. As trade talks approach, the international community remains vigilant, assessing whether this audacious maneuver will stabilize global commerce or deepen economic divisions.