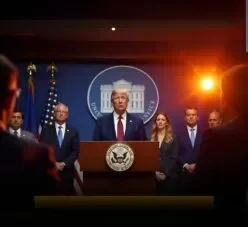

Trump Signs the Bill That Crushes IRS Crypto Rule — DeFi Gets a Green Light!

In a major development for the cryptocurrency world, former President Donald Trump has recently signed a bill into law that drastically changes the landscape of crypto regulation in the U.S. By eliminating the IRS’s strict crypto reporting rules, this legislation promises a fresh start for the cryptocurrency industry, offering substantial benefits for decentralized finance (DeFi) and blockchain-based platforms. This new law has the potential to reshape how crypto operates in America and across the globe.

A Key Shift in Crypto Regulations

The bill’s signing comes as a relief to many in the crypto community who have long opposed the IRS’s stringent requirements on reporting digital asset transactions. Under previous regulations, individuals and crypto exchanges were expected to report detailed transaction data, including wallet addresses and amounts, leading to concerns about privacy and security. Critics argued that these rules were burdensome and restrictive, potentially stifling the growth of cryptocurrency technologies and discouraging participation.

By signing this bill, Trump has effectively rolled back these onerous reporting obligations, allowing the crypto sector to operate with greater freedom. This move reflects a recognition that blockchain-based technologies and digital currencies have a significant role to play in modern finance and that overly strict regulations could hinder innovation.

The DeFi Sector Thrives

One of the most important outcomes of this bill is the positive impact it will have on decentralized finance (DeFi). DeFi refers to the use of blockchain networks to offer financial services such as lending, borrowing, and trading without the need for traditional intermediaries like banks. It has emerged as one of the most transformative aspects of the crypto space, providing individuals with greater control over their financial transactions and opening up new opportunities for financial inclusion.

The easing of regulatory pressures on crypto transactions is a game-changer for DeFi platforms, which were previously at risk of being held back by stringent rules. With fewer regulatory hurdles to navigate, DeFi projects can now expand more freely, offering innovative financial solutions to users worldwide. This could lead to a further surge in DeFi adoption, as more people seek alternatives to traditional financial institutions.

What Does This Mean for the Crypto Future?

The new law has created a more favorable environment for the continued development of cryptocurrency and DeFi technologies. With the IRS crypto reporting rules no longer in place, blockchain innovators have more space to experiment, build, and scale their platforms without worrying about excessive oversight. However, this does not mean that the regulatory environment will be static. Future regulations are likely to emerge as lawmakers continue to address the unique challenges posed by digital currencies.

The DeFi space, in particular, is poised to see significant growth in the coming years. By removing the barriers that had previously limited innovation, the law opens the door for DeFi services to attract a larger user base and provide even more robust financial services outside the traditional banking system.

As the world continues to embrace blockchain technology and decentralized financial systems, the signing of this bill is sure to be seen as a pivotal moment in the evolution of cryptocurrency in the United States.