Crypto Crash: $240M Wiped Out as U.S. Tariffs Spark Market Panic

In a week where global markets were already feeling jittery, the crypto space got slammed with another blow—this time, from unexpected U.S. tariff moves. The result? A staggering $240 million was drained from digital asset investment products in just days. For many investors, it wasn’t just a dip—it felt like a gut punch.

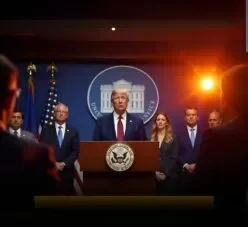

The sudden outflow came on the heels of new U.S. tariff announcements, aimed largely at Asian manufacturing imports. While not directly targeting the crypto sector, the ripple effect was immediate. Investors worldwide hit the panic button, worried that economic uncertainty and rising global tension could push riskier assets like crypto off a cliff. And for a moment, it did.

Bitcoin took the hardest hit, accounting for over $200 million of the losses alone. Ethereum followed closely behind, as both retail and institutional holders raced to the exits. But it wasn’t just about red numbers on a screen—it was the sentiment shift. Fear replaced optimism, and even seasoned traders found themselves questioning the short-term outlook.

So, what caused the chain reaction? When tariffs go up, global trade slows down. That fuels fears of a recession or at least a slowdown, which tends to make investors pull out of speculative assets—crypto being one of the most volatile among them. Add to that a series of liquidations triggered by over-leveraged positions, and you get the perfect storm.

But here’s where it gets interesting.

Despite the shakeup, this kind of market movement isn’t new. Crypto has always had its wild swings, often bouncing back even stronger. In fact, some analysts see these dips as healthy corrections—a chance to shake out weak hands and reset before the next bull run. Others believe the link between geopolitical decisions and crypto performance is only getting stronger, making it even more important for investors to stay informed beyond charts and candles.

The bottom line? This crash is a reminder that crypto doesn’t exist in a vacuum. It’s tied to the real world—economies, politics, and public sentiment. While the $240 million outflow might sting today, seasoned players know it’s part of the game. For newcomers, it’s a lesson in volatility—and the importance of playing the long game.