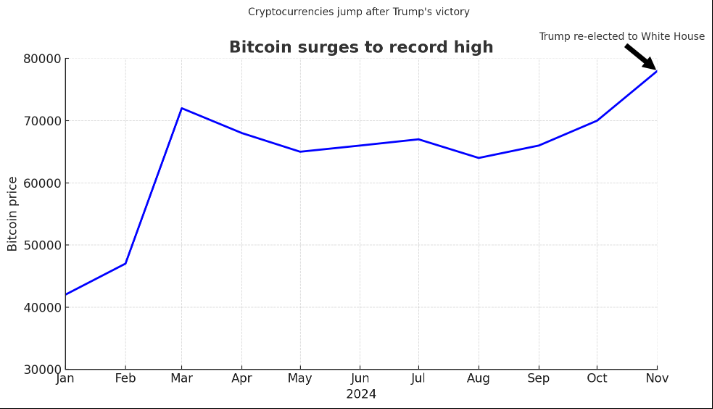

Bitcoin Hits Record High as Trump’s Election Ignites Crypto Surge

Bitcoin has skyrocketed to a new record above $82,000, fueled by expectations of a crypto surge driven by a pro-crypto environment under President Trump and supportive candidates in Congress. The cryptocurrency, which had fallen to $38,505 earlier this year, has more than doubled in value, briefly reaching a high of $82,527. This surge signals growing optimism for the future of digital assets as political changes could accelerate their mainstream adoption.

Did you know that the rise of Bitcoin has also sparked interest in other digital assets like Ethereum, which is gaining traction for its innovative smart contract technology?

Bitcoin Hits New Record High!

Bitcoin Hits New Record High!

Trump Champions Digital Assets, Aims to Make U.S. ‘Crypto Capital of the World’

As the ‘Trump Pump’ fuels Bitcoin’s rise, analysts predict a surge in crypto support, with Republicans poised to take control of Congress and push for less regulation. According to Matt Simpson, senior market analyst at City Index, the crypto community is betting big on a future of digital currency deregulation.

Simpson cautioned that Trump’s immediate focus may be elsewhere, but crypto investors are optimistic, anticipating less scrutiny from U.S. Securities and Exchange Commission Chair Gary Gensler, whom Trump has vowed to remove. The cryptocurrency industry backed pro-crypto candidates with over $119 million, helping many secure victories. In Ohio, one of crypto’s biggest adversaries, Senate Banking Committee Chair Sherrod Brown, was ousted. Meanwhile, pro-crypto candidates from both parties triumphed in Michigan, West Virginia, Indiana, Alabama, and North Carolina.

In September, Trump launched a new crypto venture, World Liberty Financial, though details remain scarce. Despite the mystery, investors are seeing his involvement as a positive sign for the industry. Adding to the momentum, billionaire Elon Musk, a close Trump ally, continues to champion cryptocurrencies.

Eric Trump, son of the president-elect and EVP of The Trump Organization, is set to speak at a major Bitcoin conference in Abu Dhabi next month, according to event organizers. Experts believe the incoming Trump administration could bring faster regulatory clarity, increased institutional interest, better market infrastructure, and wider mainstream adoption. Deutsche Bank’s Marion Laboure noted that Trump’s more practical approach could offer a stark contrast to recent regulatory restrictions.

Since Trump’s election win, there has been a notable surge in flows into cryptocurrency exchange-traded funds (ETFs). On November 7, Bitcoin ETFs saw record-breaking inflows of $1.38 billion, according to Citigroup data. Citi analysts predict this trend will continue, with ETF inflows driving Bitcoin’s strong performance.

Cryptocurrency gains have been widespread, with Ether surpassing $3,200 for the first time in three months, and Dogecoin hitting a three-year high after its satirical beginnings in 2013.

U.S.-listed cryptocurrency stocks saw a sharp rise in premarket trading, with Coinbase Global (COIN.O) soaring over 16% and iShares Bitcoin Trust (IBIT.O) climbing 7.3%. Crypto miner Riot Platforms (RIOT.O) jumped more than 10%, while MicroStrategy (MSTR.O), a major corporate supporter of Bitcoin, gained 11.3%.

Deutsche Bank’s Marion Laboure predicts that Federal Reserve rate cuts could further boost the cryptocurrency market, creating a more favorable environment for growth.