Bitcoin Drops to $76K After China Imposes 84% Tariffs on U.S.—Fed Action on the Horizon?

Bitcoin experienced a sharp decline, dropping to $76,000 after China retaliated against the U.S. with an 84% tariff on American goods. This sudden move by China has had far-reaching consequences across global financial markets, with the cryptocurrency space being particularly volatile in response. The tariff, part of the ongoing trade war between the U.S. and China, added fuel to already tense economic conditions, shaking investor confidence.

Bitcoin and the Ripple Effects of Tariffs

Bitcoin, known for its price fluctuations, has been significantly impacted by global economic events. In this case, the 84% tariff imposed by China caused immediate ripples across the markets. Investors reacted swiftly, and Bitcoin’s price saw a notable dip, dropping from its previous highs to $76K. This reflects the sensitivity of cryptocurrencies to geopolitical events, especially those related to trade policies that influence global economic stability.

The tariff war has long been a source of concern for market analysts. As China retaliates, many fear that further trade disputes could exacerbate global inflation and slow economic growth. For Bitcoin, a digital asset often seen as both a hedge and a risk, such uncertainty leads to market swings, as investors seek safer options in times of instability.

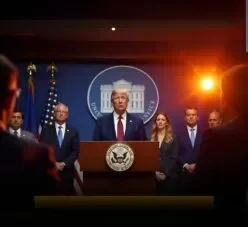

The Federal Reserve’s Potential Actions

As the markets brace for more volatility, attention turns to the Federal Reserve and its potential response. Given the economic uncertainty triggered by the tariff war and the ongoing inflationary pressures, many analysts expect the Fed to intervene. The possibility of rate cuts or other monetary policies to stabilize the economy is now on the table. The Federal Reserve’s actions will be critical in determining whether Bitcoin and other assets can recover from the current downturn or if further drops are inevitable.

The market is already anticipating how the Fed will manage the ongoing risks. In the wake of China’s tariffs, the potential for more interest rate cuts could influence market sentiment and Bitcoin’s price trajectory. These factors are driving traders to closely monitor both central bank actions and geopolitical developments.

Bitcoin’s Role in a Volatile Market

Despite the price drop, Bitcoin remains an integral part of the global financial ecosystem. Its role as a digital asset and store of value continues to attract attention, even during times of market turbulence. As we’ve seen in previous years, Bitcoin’s volatility can often present both opportunities and risks for investors. Its decentralized nature allows it to operate outside traditional financial systems, making it a unique asset during times of crisis.

However, Bitcoin’s future remains uncertain, especially as the tariff war between the U.S. and China continues to escalate. Investors will need to weigh the short-term risks posed by global trade tensions against the long-term potential of Bitcoin and other cryptocurrencies in the ever-evolving digital economy.

Conclusion

The sharp drop of Bitcoin to $76K in response to China’s tariff imposition underscores the volatile nature of cryptocurrency markets. As the Federal Reserve prepares for possible interventions, the broader financial world will be watching closely. Whether Bitcoin can recover or continue to face pressure depends largely on global economic conditions, regulatory decisions, and the actions of central banks in the coming months. For now, investors and market watchers alike are on edge, waiting to see how these pivotal events unfold.