As BTC Futures Draw Billions, Bitcoin Approaches $64K; Risk Assets Rise Amid BoJ's Hike Pause

Resuming yen rises, which precipitated a market collapse in July, is not something the Bank of Japan will undertake quickly.

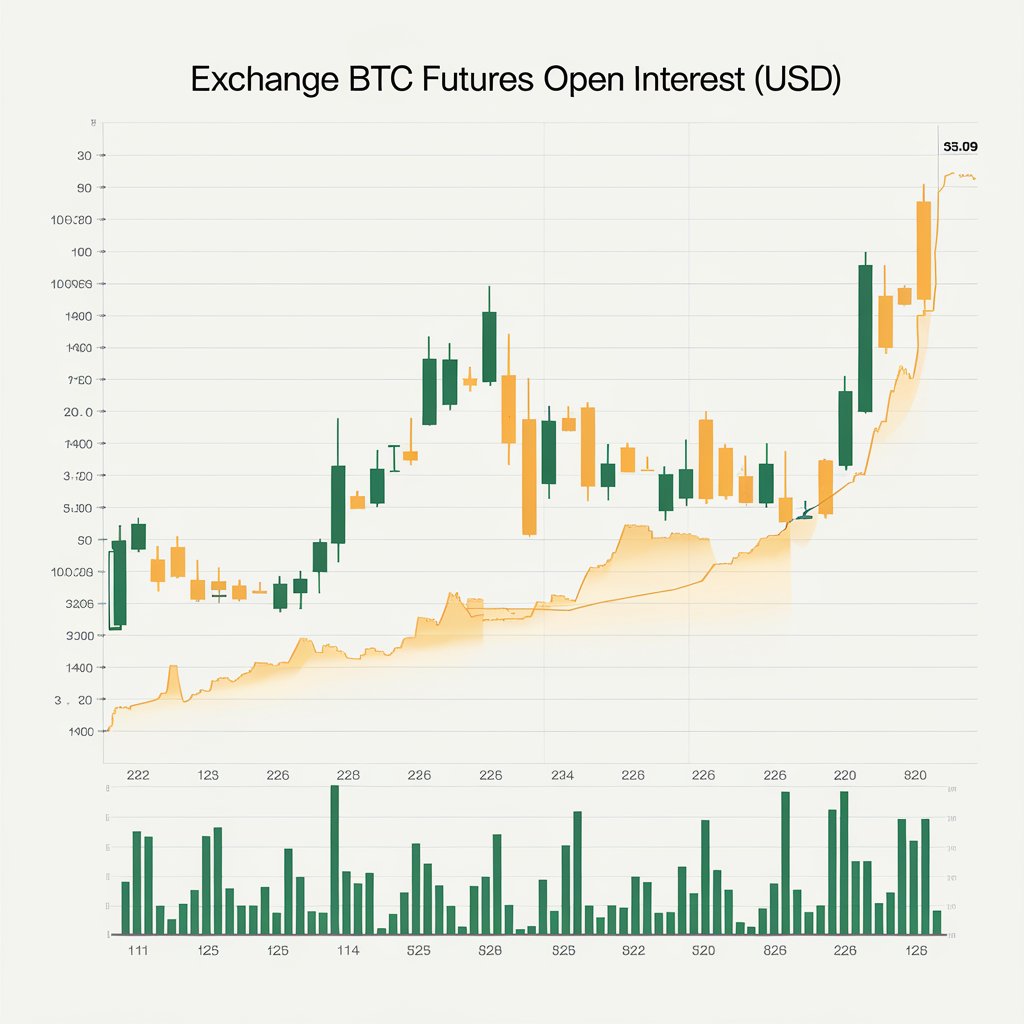

- Bitcoin bets have increased by about $5 billion since Tuesday, as indicated by recent open interest data. Meanwhile, Solana (SOL) and Ether (ETH) surged by up to 7%, leading the advances among major cryptocurrencies.

Since Tuesday, open interest data indicates a nearly $5 billion increase in Bitcoin wagers. After a hectic few days that included rate cuts by the U.S. Federal Reserve, a pause in cuts by the Bank of England, and a decision by the Bank of Japan (BoJ) to maintain its rates on Friday, Bitcoin (BTC) extended its one-week gains to 10%.

On Friday morning in Asia, Bitcoin briefly surpassed $64,000 before retreating from its gains. The BoJ’s decision to maintain its current stance prevented a repetition of the market collapse that occurred in July when it raised interest rates.

Additionally, Solana (SOL) and Ether (ETH) surged by up to 7%, leading advances among major cryptocurrencies.

Macroeconomic data, according to traders, points to potential for higher-risk investments like bitcoin in the upcoming months. In a market webcast on Friday, traders from QCP Capital stated, “The US 2Y/10Y treasury spread, an indicator of recession, has been inverted since July 2022 but has recently steepened to +8bps.” “This indicates a shift toward riskier assets and market optimism.”

Higher yields on short-term debt instruments than on long-term debt can be interpreted as a caution flag for riskier assets and the economy as a whole since they suggest that fiscal and monetary policy are tight and that future economic contraction is possible.

Bitcoin investments have increased by around $5 billion since Tuesday, signaling a surge of new capital entering the market as traders expect future volatility. This notable rise in open interest underscores the increasing confidence among investors that Bitcoin’s price may keep climbing, particularly given recent market changes.

A ratio that monitors the active buying volume compared to selling volume shows that traders are mainly leaning towards long positions, indicating a bullish outlook. This pattern suggests that more investors are wagering on price increases rather than decreases, reflecting a tempered optimism regarding Bitcoin’s short-term performance.

As the market prepares for possible price shifts, this spike in bullish activity could lead to heightened volatility, offering traders chances to take advantage of swift price changes. Being aware of market trends and developments will be essential for investors aiming to navigate this ever-changing environment.

The Resurgence of MemeCoins: A Sign of Shifting Investor Sentiment

In the last day, cryptocurrency markets surged higher, led by gains in layer-1 tokens and memes. Avalanche’s AVAX, Aptos’ APT, and Immutable’s IMX all saw significant gains, with Solana’s SOL and ether (ETH) rising as much as 7% to lead the way. According to MitraCrypto data, memecoins led by bonk (BONK) increased by as much as 10%, indicating a return to risk-taking activity. As investor sentiment shifts towards riskier assets, the growing interest in memecoins is indicative of a broader trend in the cryptocurrency market.

Analysts suggest that this resurgence could be attributed to increased retail participation and the community-driven nature of memecoins, which often leads to rapid price movements. Moreover, with upcoming events such as major crypto conferences and potential regulatory developments, market participants are closely monitor how these factors might influence the overall market trajectory. Keeping an eye on social media trends and community sentiment can provide valuable insights for investors navigating this volatile landscape.

As the market evolves, those who stay informed and adaptable will be best positioned to capitalize on the exciting opportunities that lie ahead.